Building a financial roadmap might sound like a big deal, but really, it’s just about figuring out where you want your money to take you. Think of it like planning a trip – you wouldn’t just hop in the car without knowing your destination, right? Your Personal Finance journey needs a map too. This guide breaks down how to create that map, making sure it actually leads you to the life you’re dreaming of, not just some random place. We’ll cover getting clear on your goals, understanding your current money situation, making a sensible budget, setting up for the unexpected, and making sure your plan can keep up as life happens.

Key Takeaways

- Clearly define what you want your future to look like, then set specific financial goals that align with those life aspirations.

- Get a handle on your current money situation by tracking income and expenses, and understanding your assets and debts.

- Create a realistic budget that balances your needs and wants, and consider using a simple rule like 50/30/20.

- Build an emergency fund to cover unexpected costs and invest wisely for long-term growth, letting compound interest work for you.

- Regularly review and adjust your financial plan to account for life’s changes and ensure you stay on track toward your goals.

Define Your Financial Aspirations

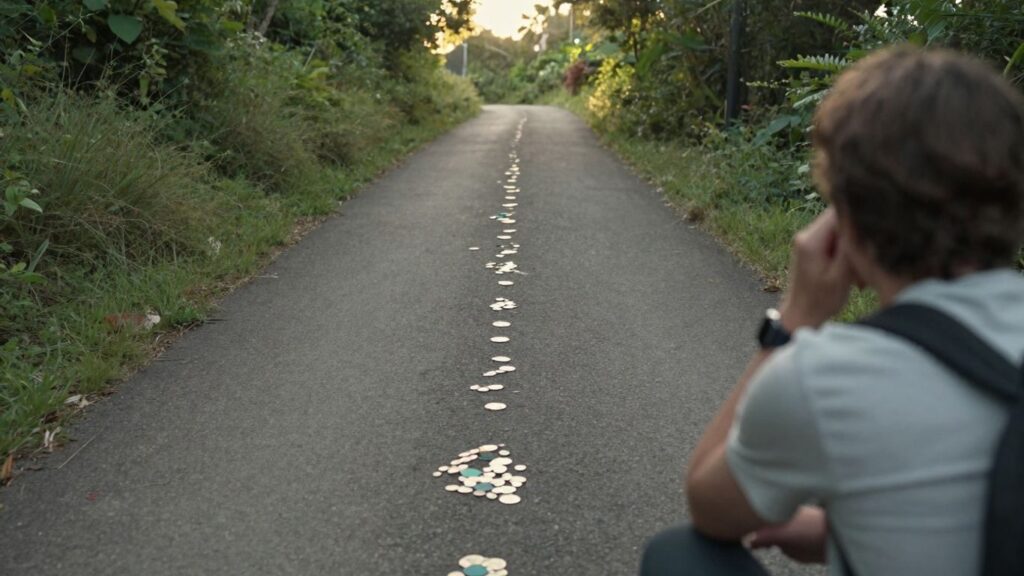

Before you can build a solid financial plan, you need to know what you’re actually aiming for. Think of it like setting a destination on your GPS before you start driving; you wouldn’t just hit the road without knowing where you want to end up, right? Your financial roadmap is no different. It’s about figuring out what you want your life to look like, not just next year, but down the road. This isn’t just about money; it’s about the life you want to live.

Identify Your Life Goals

What does your ideal future look like? Take some time to really think about it. Are you dreaming of owning a home, traveling the world, starting your own business, or maybe retiring early with plenty of freedom? These aren’t just vague wishes; they are the building blocks of your financial journey. Jot them down. Be specific. Instead of ‘save money,’ try ‘save $50,000 for a down payment on a house in the next five years.’

- Dream Vacation: Where do you want to go?

- Home Ownership: What kind of home and where?

- Career Milestones: What do you want to achieve professionally?

- Family Needs: Education for kids, supporting parents?

- Retirement Vision: What does a comfortable retirement mean to you?

Prioritize What Matters Most

Once you have a list of potential goals, it’s time to sort them out. You probably can’t do everything at once, and that’s okay. Look at your list and decide what’s most important to you right now and in the near future. Some goals might be more urgent, while others can wait. Aligning your money with your values is key here. If financial security for your family is your top priority, then building an emergency fund and getting adequate insurance might come before that exotic vacation.

Here’s a simple way to think about it:

- Must-Haves: Goals that are critical for your well-being and security (e.g., emergency fund, debt repayment).

- Should-Haves: Important goals that significantly improve your life (e.g., saving for a house down payment, retirement contributions).

- Nice-to-Haves: Goals that would be great but aren’t essential (e.g., a luxury car, frequent expensive vacations).

Visualize Your Future Self

This is where you really connect with your aspirations. Imagine yourself in five, ten, or even twenty years, having achieved these goals. What does that feel like? What does your day-to-day life look like? This mental picture can be a powerful motivator. It helps turn abstract financial targets into something tangible and exciting. Seeing yourself happy and secure because you planned ahead makes the effort worthwhile. It’s about creating a future you’re excited to work towards, not just one you feel obligated to achieve.

Thinking about your future self isn’t just a daydream; it’s a strategic exercise. It helps you understand the ‘why’ behind your financial decisions, making it easier to stick to your plan when things get tough. It transforms saving and investing from a chore into a purposeful act of self-care for your future.

Assess Your Current Financial Standing

Before you can map out where you’re going, you really need to know where you are right now. Think of it like trying to find a new restaurant without knowing your current location – you’d just be wandering around.

Track Your Income and Expenses

This is about getting a clear picture of the money coming in and the money going out. It sounds simple, but it’s easy to overlook small purchases or forget about that subscription you signed up for ages ago. Knowing your cash flow is the bedrock of any solid financial plan.

Here’s a quick breakdown:

- Income: This includes your salary after taxes, any freelance work, side hustles, or even gifts. Basically, any money you receive.

- Expenses: This is everything you spend money on. It’s helpful to break this down into categories like housing (rent/mortgage, utilities), food, transportation, debt payments, entertainment, and personal care.

It’s a good idea to look at this data over a month or two. You might be surprised where your money is actually going. A simple spreadsheet or a budgeting app can make this process much easier.

Understand Your Assets and Liabilities

Now, let’s look at what you own and what you owe. This gives you a snapshot of your net worth.

- Assets: These are things you own that have value. This includes cash in your bank accounts, savings, investments (like stocks or retirement funds), and even significant possessions like a car or property.

- Liabilities: These are your debts. Think credit card balances, student loans, car loans, mortgages, or any other money you owe to others.

Subtracting your liabilities from your assets gives you your net worth. It’s a good indicator of your overall financial health.

Review Your Savings and Investments

This part focuses on the money you’ve set aside for the future. It’s not just about how much you have, but also where it’s located and what it’s doing.

- Savings: This typically refers to money in easily accessible accounts, like your checking or savings accounts, and especially your emergency fund. Is it enough to cover a few months of living expenses?

- Investments: This is money put into things like stocks, bonds, mutual funds, or retirement accounts (like a 401k or IRA). These are usually for longer-term goals and have the potential to grow over time.

Understanding these accounts helps you see how prepared you are for both unexpected events and your long-term aspirations.

Construct a Realistic Budget

Okay, so you’ve got your big dreams laid out. That’s awesome. But dreams don’t pay the bills, right? This is where we get down to the nitty-gritty: building a budget. Think of it less like a restriction and more like a game plan for your money. A good budget shows you where your cash is actually going, so you can steer it toward what you actually want.

Allocate Funds for Needs and Wants

First things first, let’s sort your spending into two main buckets: needs and wants. Needs are the non-negotiables – rent or mortgage, utilities, groceries, transportation to work, insurance. These are the things you absolutely have to pay to live and function. Wants, on the other hand, are the fun stuff: dining out, streaming subscriptions, new gadgets, vacations. It’s not about cutting out all the wants (that’s a recipe for burnout!), but about being intentional with them. You need to know how much is going to the essentials before you decide how much you can comfortably spend on, say, that new video game or concert tickets.

Implement the 50/30/20 Rule

This is a super popular way to get a handle on your budget without getting bogged down in every single penny. The idea is pretty straightforward:

- 50% for Needs: Aim to spend about half of your take-home pay on your essential living expenses.

- 30% for Wants: This is your fun money! Use this portion for entertainment, hobbies, travel, and other discretionary spending.

- 20% for Savings & Debt Repayment: This is where you build your future. Put this towards your emergency fund, retirement accounts, or paying down debt faster.

It’s a guideline, not a rigid law. If your needs take up 60%, you might need to trim your wants or find ways to increase income. The point is to have a clear structure.

Utilize Budgeting Tools and Apps

Nobody wants to stare at spreadsheets all day, unless you’re into that sort of thing. Luckily, there are tons of tools out there to make budgeting way less painful. You’ve got apps that link to your bank accounts and automatically categorize your spending. Others let you manually input everything, which can be great for really digging into the details. Some people prefer a simple notebook and pen, and that’s totally fine too! The best tool is the one you’ll actually use consistently. Find something that fits your style and makes tracking your money feel less like a chore and more like a habit.

Budgeting isn’t about deprivation; it’s about making conscious choices. It’s about telling your money where to go instead of wondering where it went. By understanding your spending patterns and setting clear limits, you gain control and can actively direct your financial resources towards your long-term aspirations.

Build a Safety Net and Invest Wisely

Okay, so you’ve got your budget sorted and you know where your money’s going. That’s a huge step! But what happens when life throws a curveball? That’s where building a solid safety net and making your money work for you comes in. It’s not just about saving; it’s about smart saving and investing.

Establish an Emergency Fund

Life’s unpredictable, right? One minute you’re cruising along, the next your car decides to impersonate a fountain, or you get an unexpected medical bill. Without a buffer, these things can totally wreck your financial progress. An emergency fund is basically your financial shock absorber. Experts usually say you should aim for three to six months of your essential living expenses stashed away. This money needs to be easy to get to, so a separate savings account is perfect. Think of it as peace of mind in a bank account. Setting up automatic transfers from your checking to your savings account is a great way to build this up without even thinking about it. You can get started with setting up an emergency fund today.

Align Investments with Time Horizon

Now, let’s talk about making your money grow. Saving is great, but investing is how you really build wealth for those bigger, longer-term goals like retirement or a down payment on a house. The key here is matching your investments to when you’ll need the money. If you’re saving for something 10 or more years away, you might consider investments that have the potential for higher growth, like stocks. They can be a bit bumpy, but over a long time, they’ve historically done well. For shorter-term goals, say, in the next few years, you’ll want something less risky, like bonds or even just keeping it in a high-yield savings account. It’s all about balancing potential growth with how soon you need access to the funds.

Leverage Compound Interest for Growth

This is where the magic happens. Compound interest is basically earning interest on your interest. It sounds simple, but over time, it can make a massive difference. The earlier you start investing, the more time compound interest has to work its magic. It’s like a snowball rolling down a hill – it starts small but gets bigger and bigger. Even small, regular contributions can add up significantly thanks to compounding. Don’t forget about retirement accounts like 401(k)s or IRAs, especially if your employer offers a match – that’s literally free money to boost your savings!

Building a financial safety net and investing wisely aren’t separate tasks; they work together. Your emergency fund protects your investments from being cashed out prematurely during tough times. Meanwhile, your investments are designed to grow your wealth over the long haul, helping you reach goals that saving alone wouldn’t achieve.

Develop Your Action Plan

Okay, so you’ve figured out what you want your money to do for you and you’ve got a handle on where you stand financially. Now comes the part where we actually make things happen. This is where we turn those dreams into a to-do list. It’s not just about wishing; it’s about doing.

Create a Debt Management Strategy

Let’s be real, debt can feel like a heavy anchor. Tackling it head-on is a big step towards financial freedom. We need to figure out what kind of debt you’re dealing with. Is it the ‘good’ kind, like a mortgage that builds equity, or the ‘bad’ kind, like high-interest credit cards that just keep growing? Your plan should focus on paying down the expensive stuff first. Think about options like the snowball method (paying off smallest debts first for quick wins) or the avalanche method (paying off highest interest debts first to save money long-term).

Here’s a simple way to think about prioritizing debt:

- High-Interest Debt: Credit cards, payday loans, personal loans with rates above 10%.

- Moderate-Interest Debt: Car loans, some student loans.

- Low-Interest Debt: Mortgages, some federal student loans.

The goal here isn’t just to make minimum payments. It’s about a focused effort to reduce or eliminate debt that’s costing you a lot of money over time. Every dollar you put towards debt is a dollar that could be working for you elsewhere.

Automate Savings and Payments

Life gets busy, and sometimes the best way to stick to a plan is to make it automatic. Setting up automatic transfers from your checking account to your savings or investment accounts means you don’t have to remember to do it. It’s like paying yourself first, without even thinking about it. The same goes for bills. Automating payments can help you avoid late fees and keep your credit score in good shape. This simple step can make a huge difference in consistency.

Seek Professional Financial Guidance

Sometimes, you just need a second pair of eyes, especially when it comes to something as important as your finances. A financial advisor can help you see things more clearly, offer advice tailored to your specific situation, and keep you accountable. They’ve seen a lot and can help you avoid common pitfalls. Think of them as a guide on your financial journey, helping you stay on track and make smart decisions, especially when things get complicated or when you’re facing big life changes.

Adapt Your Financial Roadmap

Life has a funny way of throwing curveballs, doesn’t it? One minute you’re cruising along, and the next, things shift. Your financial roadmap isn’t meant to be set in stone; it’s more like a living document. Think of it as your personal GPS for money – sometimes you need to reroute based on new information or unexpected detours. Regularly checking in and making adjustments is key to staying on track toward those big goals you set.

Review Your Plan Annually

It’s a good idea to set aside time at least once a year to really look at your financial plan. This isn’t just about seeing if you’re hitting numbers; it’s about making sure the plan still fits you. Has your income changed? Are your priorities different now? Maybe you got a raise, or perhaps you decided that saving for a big vacation is more important right now than aggressively paying down a low-interest loan. An annual review helps you catch these things before they become big problems.

Adjust for Major Life Events

Some changes are too big to wait for an annual check-in. Things like getting married, welcoming a new baby, buying a house, or even changing jobs can significantly impact your finances. When these big moments happen, it’s time to pause and see how they affect your budget, savings, and investment strategy. For instance, a new child means new expenses, and buying a home changes your monthly outgoings. You’ll want to update your emergency fund, insurance, and maybe even your retirement contributions.

Here are a few common life events that usually require a financial plan update:

- Starting a family: Think about increased costs for childcare, education savings, and life insurance.

- Buying property: This involves saving for a down payment, closing costs, and adjusting your budget for mortgage payments and property taxes.

- Career changes: A new job might mean a different salary, new benefits, or the need to roll over retirement accounts.

- Significant debt changes: Paying off a large debt or taking on new debt will alter your cash flow and savings potential.

Stay Flexible with Changing Priorities

What you wanted five years ago might not be what you want today, and that’s perfectly normal. Your financial roadmap should reflect your current values and aspirations. If your priorities shift – maybe you decide to pursue further education, start a side business, or focus more on experiences than material possessions – your financial plan needs to adapt. Don’t be afraid to tweak your savings goals, investment mix, or spending habits to align with what truly matters to you now.

The most effective financial plans are those that can bend without breaking. Life is unpredictable, and your financial strategy should be built with that reality in mind. Regular, thoughtful adjustments are not a sign of failure, but rather a sign of smart, proactive financial management.

If you’re feeling unsure about how to make these adjustments or if a major life event has thrown you for a loop, don’t hesitate to talk to a financial advisor. They can help you see things clearly and make the necessary changes to keep your roadmap pointed in the right direction.

Your Financial Journey Starts Now

So, building a financial roadmap isn’t some super complicated thing only finance wizards can do. It’s really about figuring out what you want your life to look like and then making a plan to get there with your money. We talked about knowing where you stand right now, setting clear goals, making a budget that actually works for you, and saving up for unexpected stuff. Plus, we touched on making your money grow and why it’s important to tweak your plan as life happens. Remember, this isn’t a set-it-and-forget-it kind of deal. Your plan should grow with you. If it all feels a bit much, don’t sweat it. Talking to someone who knows their stuff can make a huge difference. The main thing is to just get started. Your future self will thank you for it.

Frequently Asked Questions

What’s the main idea behind creating a financial roadmap?

Think of a financial roadmap like a GPS for your money. It helps you figure out where you want to go with your finances and maps out the best way to get there. It’s all about making sure your money helps you reach the things you really want in life, like buying a house or having a comfy retirement.

Why is it important to know where my money is going?

Knowing where your money goes is like checking your starting point on a map. By tracking your income (money coming in) and expenses (money going out), you can see if you’re spending too much on things you don’t really need and find extra cash to save for your goals.

What’s the 50/30/20 rule, and how does it help my budget?

The 50/30/20 rule is a simple way to divide your money. It suggests using 50% for things you absolutely need (like rent and food), 30% for things you want (like movies or new clothes), and 20% for saving or paying off debt. It helps you balance enjoying life now with planning for the future.

What is an emergency fund, and why do I need one?

An emergency fund is like a financial cushion for unexpected stuff. Life can throw curveballs, like a car breaking down or a surprise medical bill. Having 3 to 6 months of your living expenses saved up in an easy-to-reach account means these surprises won’t mess up your long-term plans.

How does investing help me reach my goals?

Saving is good, but investing can make your money grow much faster, especially for big, long-term goals like retirement. The magic of compound interest means your earnings start earning more money over time. It’s like planting a seed that grows into a tree.

Do I need to change my financial plan if my life changes?

Absolutely! Your financial roadmap isn’t set in stone. Life is always changing – you might get married, have kids, change jobs, or buy a house. When big things happen, you need to look at your plan again and make changes to make sure it still fits your new life and goals. It’s a good idea to check it at least once a year.